From the Sensex pack, IndusInd Bank, Infosys, Bajaj Finserv, Mahindra & Mahindra, Zomato, Hindustan Unilever, Power Grid, Axis Bank, UltraTech Cement, Adani Ports, and Tata Consultancy Services were among the laggards. File

Equity benchmark indices Sensex and Nifty ended on a flat note in a lacklustre trade on Tuesday (March 11, 2025) as investors preferred to remain on the sidelines awaiting further triggers ahead of macroeconomic data release.

The 30-share BSE Sensex dropped 12.85 points or 0.02% to settle at 74,102.32. During the day, it slumped 451.57 points or 0.61% to hit a low of 73,663.60.

However, the broader index Nifty rose 37.60 points or 0.17% to close at 22,497.90. In the session, the benchmark advanced by 61.8 points or 0.27% to hit a high of 22,522.10.

From the Sensex pack, IndusInd Bank, Infosys, Bajaj Finserv, Mahindra & Mahindra, Zomato, Hindustan Unilever, Power Grid, Axis Bank, UltraTech Cement, Adani Ports, and Tata Consultancy Services were among the laggards.

On the other hand, Sun Pharmaceuticals, ICICI Bank, Bharti Airtel, HCL Technologies, Maruti Suzuki India, Larsen & Toubro, Reliance Industries, Kotak Mahindra Bank and Titan were the gainers.

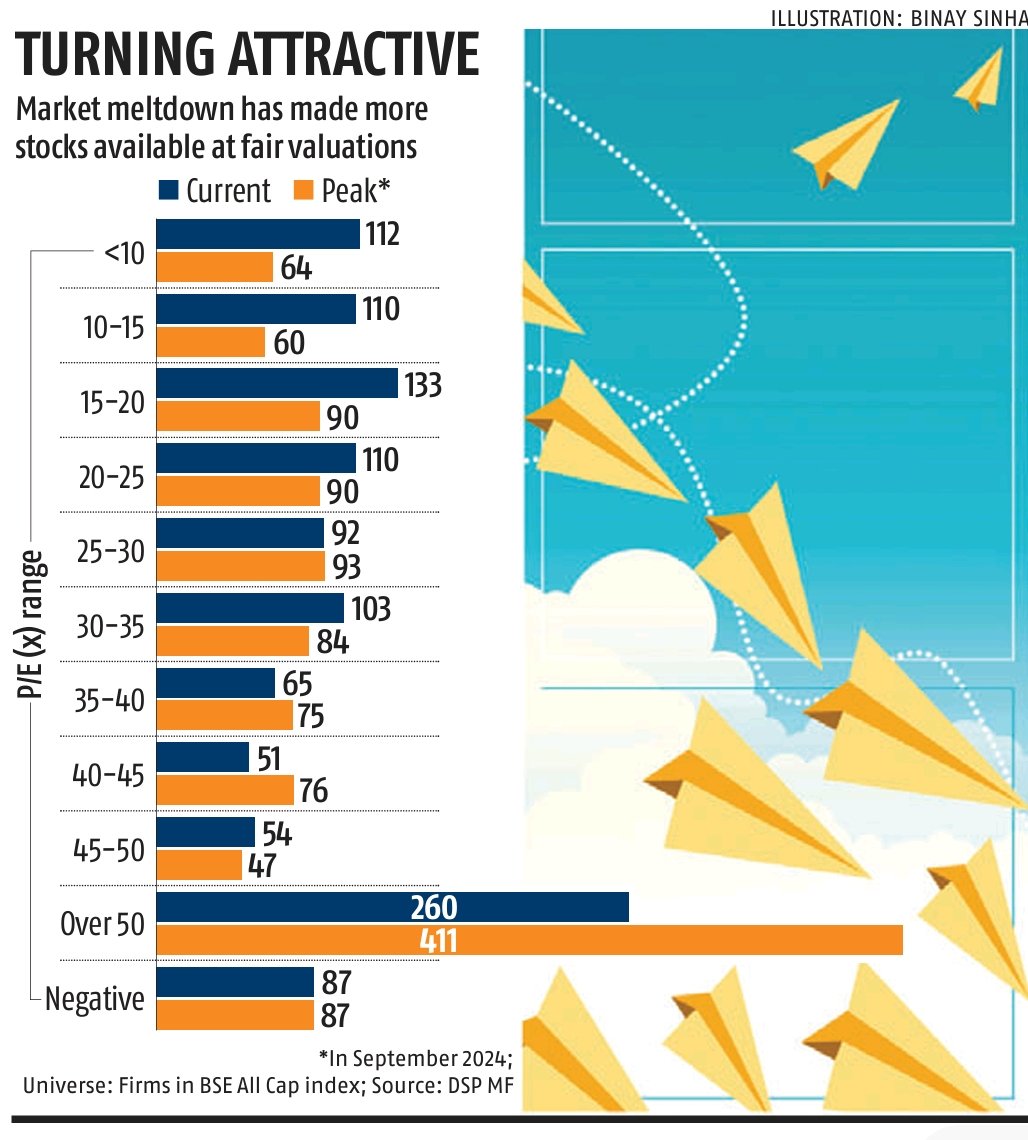

“Despite significant sell-offs in the U.S. and other Asian markets driven by concerns over an economic slowdown caused by the ongoing trade war, the domestic market is showing signs of a gradual recovery.

“Its relatively lower volatility can be attributed to a moderation in valuations, following recent corrections, along with supportive factors like falling crude oil prices, an easing Dollar Index, and expectations of a rebound in domestic earnings,” Vinod Nair, Head of Research, Geojit Financial Services, said.

“The attention remains on the upcoming retail inflation data, which could provide insights into potential interest rate cuts,” Mr. Nair added. In Asian markets, Tokyo and Seoul ended lower, while Hong Kong settled flat. Shanghai stock markets finished in the green territory.

The U.S. markets plunged to 4% in overnight deals on Monday (March 10, 2025.) Global oil benchmark Brent crude rose 0.71% to $69.77 a barrel.

Meanwhile, Foreign Institutional Investors (FIIs) offloaded equities worth ₹485.41 crore, while Domestic Institutional Investors (DIIs) picked up equities worth ₹263.51 crore on Monday (March 10, 2025), according to exchange data.

On Monday (March 10, 2025), the 30-share BSE Sensex declined 217.41 points to settle at 74,115.17. The Nifty declined by 92.20 points to close at 22,460.30.

Published – March 11, 2025 05:07 pm IST

Leave a Reply