According to stock market analysts, the domestic macros are highly positive.

| Photo Credit: PTI

Equity market benchmarks Sensex and Nifty climbed in early trade on Thursday (March 13, 2025) driven by buying in index heavyweights ICICI Bank and Reliance Industries amid a robust domestic macroeconomic data and firm trend in the global peers.

The 30-share BSE Sensex climbed 192.32 points or 0.26 per cent to 74,222.08 in the morning trade. The NSE Nifty rose 21.75 points or 0.1 per cent to 22,492.25.

From the Sensex pack, Tata Steel, Bajaj Finserv, ICICI Bank, Bajaj Finance, State Bank of India, Zomato, Bharti Airtel, PowerGrid, NTPC and Titan were among the gainers.

In contrast, IndusInd Bank, ITC, UltraTech Cement, Asian Paints, Tata Motors, Axis Bank, Mahindra & Mahindra, and Nestle India were the laggards.

“The market will be moving in the midst of domestic tailwinds and global headwinds on Thursday (March 13, 2025) . The domestic macros are highly positive,” V.K. Vijayakumar, Chief Investment Strategist, Geojit Financial Services, said.

Consumer Price Index (CPI)-based retail inflation slipped to a seven-month low of 3.61 per cent in February mainly due to easing prices of vegetables, eggs, and other protein-rich items, creating space for the RBI to go for another cut in interest rate next month.

The second set of data released by the National Statistics Office (NSO) showed that the growth in Index of Industrial Production (IIP), a measure of performance of industries, accelerated to 5 per cent in January 2025, driven by a rebound in manufacturing activity.

Vijayakumar further said, this macro data would have boosted the stock market where valuations are fair and even attractive in pockets. But unfortunately the global scenario is highly unfavourable with the trade war triggered by Trump getting worse.

In Asian markets, Tokyo, Shanghai, Hong Kong and Seoul were trading on a mixed note.

Wall Street ended higher in the overnight deals on Wednesday (March 12, 2025)

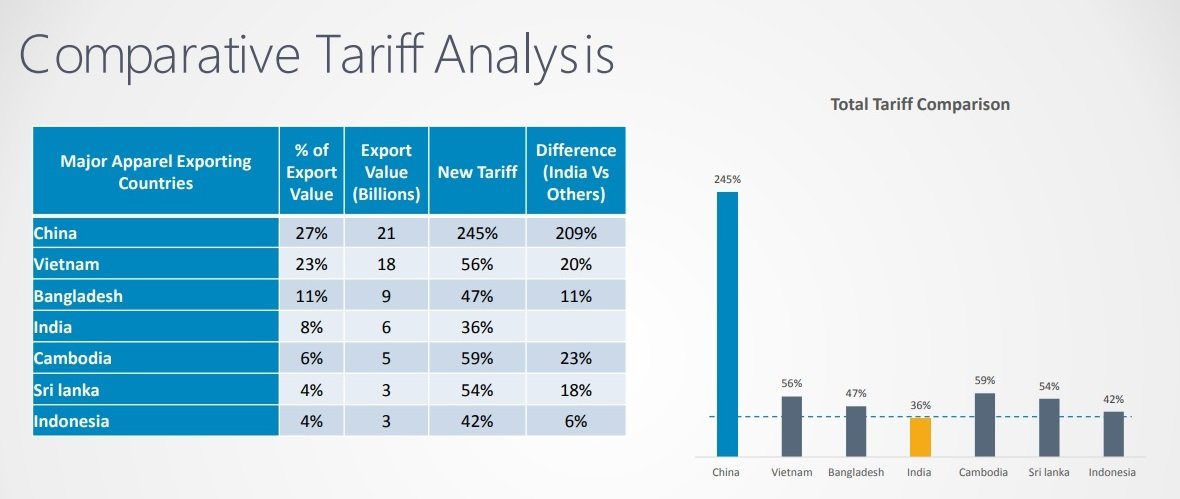

“President Donald Trump’s 25 per cent tariff on steel imports to the US has been swiftly retaliated by the European Union (EU) with tariffs on USD 28 billion of imports from the US and Canada has imposed tariffs on USD 20 billion US exports to Canada,” Mr. Vijayakumar said.

China will follow suit. This global backdrop will constrain a rally in the Indian market. Investors should focus on domestic consumption themes, he added.

Meanwhile, global oil benchmark Brent Crude traded flat at USD 70.97 a barrel.

Foreign Institutional Investors (FIIs) sold equities worth ₹1,627.61 crore, while Domestic Institutional Investors (DIIs) purchased equities worth Rs 1,510.35 crore on Wednesday, according to exchange data.

On Wednesday (March 12, 2025), the 30-share BSE Sensex fell 72.56 points to close at 74,029.76. The NSE Nifty slipped 27.40 points to end at 22,470.50.

Published – March 13, 2025 10:32 am IST

Leave a Reply